The ability to take advantage of cost segregation can be narrow if you do not qualify as a real estate professional. However, business owners have a unique loophole to take advantage of and the nature of their business has no impact on their eligibility. This blog gets a little into the weeds so contact me today if you are a business owner looking to increase your cash flow!

The Structure

The first and likely most important determining factor is that the business must have a brick-and-mortar location and the business must own the property.If we meet these criteria, the most common setup is that the property is owned by an LLC or some type of entity and the business “pays rent” to this entity. The entity is then responsible for paying the mortgage, taxes, insurance and perhaps items like maintenance and other upkeep.

The other expense line item that this LLC can take advantage of is depreciation. Depreciating the property is mandatory. The tax code assumes that this operating asset will lose some of its value annually. There are two methods to depreciating the property:

- Straight-line depreciation – the purchase price of the property minus land value and plus any renovations and improvements is divided by 27.5 or 39 years (depending on the asset class) and an even, or straight-line amount, is taken annually.

- Cost segregation – the property is itemized, or segregated, into 4 categories of class live (5-, 7-, 15- and 27.5 or 39 year). Cost seg categorizes the building more in alignment when how long it lasts as opposed to lumping all together.

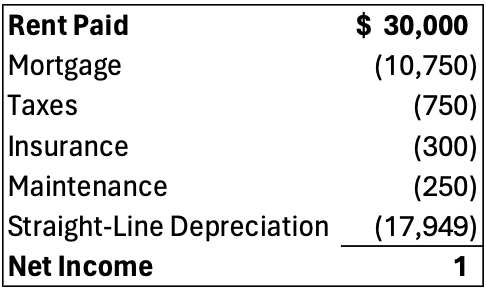

Scenario 1: Straight-Line Depreciation

So here is the baseline example of a business paying rent to their LLC. The straight-line depreciation assumes a building with a $700,000 depreciable basis (land value removed) and a 39-year class life.

As you can see, we are left with $1 of monthly profit and no taxes will be paid on this nominal amount.

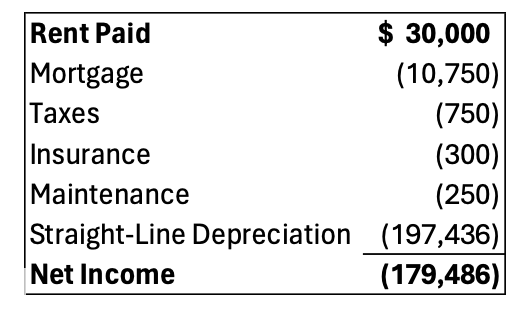

Scenario 2: Cost Segregation Depreciation

Now let’s say the owner has a cost segregation study performed and 25% of the building can be placed into the 5-, 7- and 15-year class lives. For sake of simplicity, we’ll assume the property was placed in 2022 when bonus depreciation was at 100% so we can frontload ALL 25% of this value plus 1/39th of the remaining 75% of the depreciable basis.

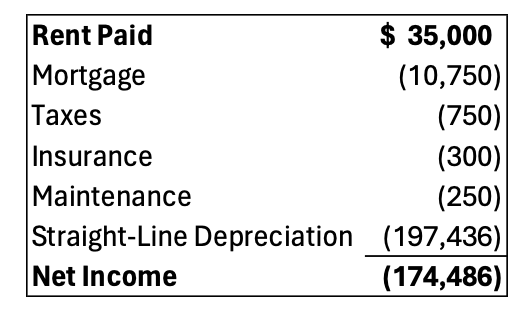

A negative balance now ensures no taxes will be paid so here’s the fun part. Let’s say “market rent” based on comparable buildings is $35,000 (i.e., the owner was paying slightly under market at $30,000).

Obviously, the balance is still negative. But what did we do? We just increased the rent expense for the business by $5,000 a month or $60,000 a year. This means the taxable net income just came down by $60,000 and at a modest 30% tax rate, the business just saved $18,000 in taxes. The business owner “paid himself” that $60,000 though so he successfully and legally saved themselves $18,000 in taxes. An entity with zero net income is not liable to pay taxes.

The “unused” portion of depreciation that brought income below zero carries forward until fully utilized. It is never lost until the property is sold. The business owner will continue to save on their taxes and over time can increase their rent as market rent allows. If the peak of market rent is $35,000, the owner CANNOT pay a rent of $50,000. This will raise big red flags!

Contact me, Your Cost Segregation Pro, today to see if your business can take advantage of this today.